A significant number of TSB staff are deferred members of one of Lloyds Banking Group’s defined benefit (final salary) pension schemes and the financial security of those schemes is important to them. Deferred members are just as important as active members.

A few weeks ago Lloyds Banking Group [The Group] announced that: “Terms have now been agreed in principle with the Trustee in respect of the valuations of the Group’s three main defined benefit pension schemes. The valuations showed an aggregate ongoing funding deficit of £7.3bn as at 31 Dec 2016 (£5.2 billion deficit at 30th June 2014)”.

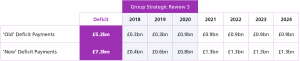

To cover the 40% increase in the size of the pension deficit, the Group and Trustee have agreed in principle new deficit contribution payments and those are set out in the table below.

At the same time it announced the new deficit, the Group said that it was planning to hand back more than £3 billion to shareholders in dividends payments including a share buy back programme worth an extra £1 billion. Despite the 40% increase in the size of the pension deficit, the Bank is only proposing to increase its deficit payments in 2018 by just £100 million, from £300 million to £400 million. Shareholders are getting £3,200,000,000; the pension schemes are only getting an extra £100,000,000.

We understand that balancing the needs of the pension schemes and shareholders is difficult, but when you are a business that is producing massive amounts of surplus cash it’s not unreasonable for us to expect some of that extra money to go to the pension schemes.

The Group is going to pay out 7.5 times more in dividends this year than it is in deficit reduction contributions. What’s worse is the fact that the Group is back-loading its pension deficit contribution payments until 2021 and kicking the can down the road. That is unacceptable.

The bulk of the deficit contribution payments should have been made up front during a period of relative stability for the UK economy. If the UK economy is affected adversely after the UK leaves the EU following the 2-year transition period, that could have serious implications for the Group, which is UK focused, and its ability to meet future pension deficit obligations.

The Dog That Refused To Bark

The pension scheme deficit has increased by 40% but the Trustee has agreed a contribution schedule that defers the bulk of the deficit payments until 2021 and beyond.

Why did the Trustee not insist that the large deficit contribution payments were made over the next three years especially when it knows that £ billions are going to be paid to shareholders in the form of dividends and buy backs?

The fact that the Trustee has agreed deficit contribution payments which put off most of the big deficit payments until 2021, when the Group is giving £3 billion+ plus to shareholders this year alone, confirms our suspicions that the Trustee is not up to the job of looking after the interests of all pension scheme members.

It is important that members of the final salary pension schemes make their views clear by writing to the Trustee opposing the new recovery plans. TBU is producing a draft letter for members to send to Mr Harry Baines and that will be sent out in the next few days.

The Role Of The Regulator

As a result of the BHS and Carillion pension scheme scandals the Pension Regulator has come under increasing pressure to engage its formal powers more quickly when dealing with pension deficits.

Last year the Pensions Regulator issued new guidelines making it clear that it is likely to intervene where it believes that schemes are not being treated fairly.

TBU believes that the deficit contribution payments being paid to the pension scheme are too low when the level of payments to the shareholders, both this year and in future years, suggests that the Group could easily afford to pay higher contributions over the next three years. It is important that pension scheme members also write to Lesley Titcombe, Chief Executive of the Pensions Regulator, asking her to review the Group’s deficit contribution payments, taking into account what it’s said about dividends and share buy backs.

Again, TBU will be producing a draft letter for members to send to the Pensions Regulator and that will also be sent out in the next few days.

Members with any questions on this Newsletter can contact the Union’s Bedford Office on 01234 716029.