As it scrambles around to cut costs, our fear is that Lloyds will try to reduce its pension deficit contributions to the defined benefit pension schemes. And the Trustee, which is made up of bank appointees and unelected Member Nominated Trustees, will agree to whatever the proposals the bank makes. We have always had serious doubts about the ability of the Trustee to look after the long-term interests of pension scheme members. This is one fight they can’t back away from.

There are hundreds of current TSB staff who still have pension benefits with Lloyds and it’s important to them that contribution levels are maintained.

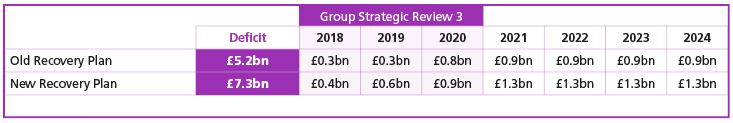

The last valuations of the three main defined benefit pension schemes showed an aggregate ongoing deficit of £7.3bn as at December 2016 compared to £5.2bn at 30th June 2014. The next funding valuation is due to be completed by March 2021 with an effective date of 31 December 2019. However, the nature of these valuations is that the Trustee and bank will already be discussing the next funding plan.

In light of the funding deficit the bank agreed to make deficit contribution of £618 million in 2019 and those payments would rise to £798 million in 2020, £1.2bn in 2021 and £1.3bn from 2022 to 2024. That would clear the pension scheme deficit. The table below sets out the deficit contributions.

Making Hay While The Sun Shines

When it announced its deficit reduction plan back in 2018, the bank said that it was also planning to hand back more than £3bn to shareholders in dividend payments including a share buy-back programme worth an extra £1bn. In a Newsletter to TSB members at the time we said:

“We understand that balancing the needs of the pension schemes and shareholders is difficult, but when you are a business that is producing massive amounts of surplus cash it’s not unreasonable for us to expect some of that extra money to go to the pension schemes.

The Group is going to pay out 7.5 times more in dividends this year than it is in deficit reduction contributions. What’s worse is the fact that the Group is back-loading its pension deficit contribution payments until 2021 and kicking the can down the road. That is unacceptable.

The bulk of the deficit contribution payments should have been made up front during a period of relative stability for the UK economy. If the UK economy is affected adversely after the UK leaves the EU following the 2-year transition period, that could have serious implications for the Group, which is UK focused, and its ability to meet future pension deficit obligations”.

We believed that the deficit payments were too low when the bank was making so much money. The Trustee should have also insisted that the bulk of the deficit contributions were paid in the early years. Many TSB members wrote to the Chairman of the Trustee Board making the same points. In that letter members asked: “Why did the Trustee not insist that the bulk of the deficit contribution payments are made over the next three year (2018, 2019 and 2020) when you knew, or should have known, that the Group would me generating cash on an unprecedented scale?” Fast forward a few years and Lloyds Banking Group is now facing an economic challenge the likes of which we have never seen before. Lloyds is the biggest retail bank and the one focused almost exclusively on the UK economy. If the recession lasts longer than everyone is expecting, then Lloyds will suffer the most. The bank will come under pressure to cut costs and its pension deficit contributions are easy pickings. Our concern is that the Trustee Board will let them get away with it.

The union will be producing a draft letter for TSB members to send to Harry Baines, Chairman of the Trustee Board, making it clear that under no circumstances should the bank be allowed to reduce its deficit contributions and push the deficit plan beyond 2024, the original date when the deficit would be paid.

Members with any issues they would like us to deal with on this should contact the Union’s Advice Team on 01234 716029 (choose Option 1).